What We Learned From “Liberation Week”

11 thoughts about Trump’s sudden reversal.

On Tuesday, White House press secretary Karoline Leavitt told reporters that President Trump was not considering a delay in his new “reciprocal” tariffs.

On Wednesday, about 13 hours after they went into effect, Trump announced a delay. Because China had retaliated with tariffs of their own, Trump wrote on Truth Social, duties on Beijing would be raised to an extraordinary 125%. But for everyone else, he said, “I have authorized a 90 day PAUSE, and a substantially lowered Reciprocal Tariff during this period, of 10%, also effective immediately.”

Here are some thoughts about the whiplash of the last week:

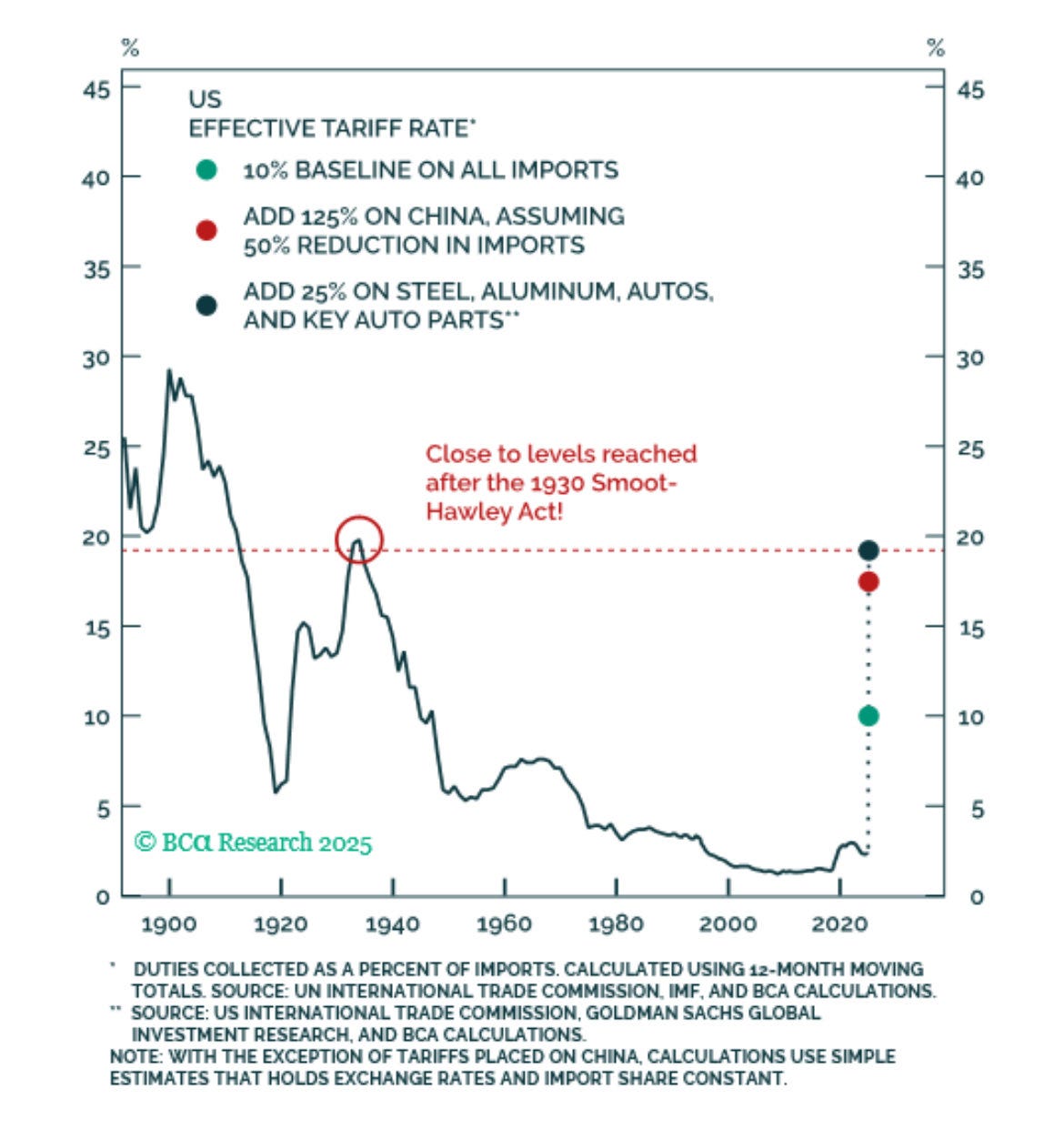

1. It’s important to note that a 10% universal tariff, 25% tariffs on the U.S.’ two largest trading partners (the previously imposed Canada and Mexico tariffs were unaffected by Wednesday’s announcement), and 125% tariffs on the U.S.’ third-largest trading partner should still be considered a dramatic change in American trade policy. Trump’s 25% tariffs on steel and aluminum, and on cars and car parts, also remain in effect.

As this chart by BCA Research’s Peter Berezin shows, the U.S. effective tariff rate will now be slightly below the level reached during the Smoot-Hawley tariffs of the 1930s — but only slightly. The tariffs being continued are still expected to raise prices, especially in the many industries where the U.S. relies on products from China, including toys, clothing, and electronics.

2. But they will not scramble America’s trade relationships with nearly every one of its key allies, or potentially spark an economic crisis by upending the global financial system. So, compared to Trump’s previous plan, Wednesday’s announcement represents a massive reversal by the president. You could almost hear the sigh of relief coming from Wall Street: the Dow saw its biggest percentage jump since March 2020. The S&P 500 had its best day since 2008. The Nasdaq had its best day since 2001.

3. The reversal shows that, despite the popular image of Trump as permanently inured from political consequences, he remains highly amenable to outside pressure, even in his second, more emboldened term.

Asked if the negative market reaction over the past few days led to Trump’s 180, Commerce Secretary Howard Lutnick told CNBC, “Absolutely not.” But Trump’s own words show that this is not true. “I thought that people were jumping a little bit out of line,” Trump said when asked why he reversed himself. “They were getting yippy, you know? They were getting a little bit yippy, a little bit afraid.”

According to the New York Times, Trump’s advisers privately admit that “the real credit” for the president’s change in course “should go to the bond markets,” which saw a sharp sell-off earlier on Wednesday. “Mr. Trump’s decision was driven by fear that his tariffs gamble could quickly turn into a financial crisis,” the Times added.

4. A similar dynamic has played out on several other issues. Trump’s aggressive rhetoric often masks the sheer number of decisions he reverses himself on, as I chronicled last month. The second Trump administration has embraced a “move fast and break things” philosophy, reasoning that it’s better to act quickly and fix any mistakes later than not to act at all.

This approach certainly succeeds in grabbing eyeballs — “the president has captivated the attention of the world,” Leavitt bragged at a briefing this week — but not always much else. In fact, sometimes undue speed can have adverse consequences. A different example of that came on Wednesday, when a Trump-appointed judge in Texas temporarily blocked the administration from carrying out certain deportations under the Alien Enemies Act. (These are some of the same deportations that a judge in D.C. had blocked, until the Supreme Court said they needed to be litigated in the jurisdictions where the migrants are being held.) That is notable in of itself, but I was struck by the fact that the judge cited the mistaken deportation of Kilmar Abrego Garcia as a reason for the pause. This is the Trump administration’s speed coming back to bite them. Perhaps it’s better to move fast than to move deliberately, but it keeps seeming to impair their own agenda (unless, of course, the agenda is attention).

Despite the bravado, each time one of these reversals or corrections takes place, it only serves to dent the armor of power Trump has tried to project around himself, as he is repeatedly made to bend to the law, or the markets, or the private whisperings of Republican lawmakers.

5. And yet, it was also notable that most of the whispering remained private, not public. This was probably the most criticism Trump had received from Republican lawmakers in his second term, and it was still relatively muted. Certainly, it never seemed like there was much of a chance that Congress would flex its own power and try to block Trump legislatively.

Last month, when the House used a procedural maneuver to block efforts to force a vote on Trump’s Canada/Mexico tariffs, one Republican voted against it. Yesterday, before Trump’s reversal, the House used the same trick to block a vote on Trump’s reciprocal tariffs. The Republican dissent ticked up only from one to three, and one of them (Indiana’s Victoria Spartz) was likely only voting against the procedural move it also advanced a budget resolution she opposed. Only two House Republicans (Kentucky’s Thomas Massie and Ohio’s Mike Turner) took issue with their colleagues making it harder to override the president on tariffs.

Many GOP lawmakers clearly still express their policy concerns to Trump, and he often follows these concerns, which is an important dynamic to take note of. But the tariff episode was yet another reminder that, when push comes to shove, most Republican lawmakers will fall in line, no matter how high the stakes. Even on a policy that Trump reportedly worried might cause a depression.

6. This is unfortunate, because the last week has been a great proof-of-concept for why we have a Congress. Trump was asked Wednesday how he would decide which countries would and wouldn’t face tariffs going forward, and he responded: “Instinctively, more than anything else.”

Needless to say, the Framers did not intend for economy-altering policy to be made on instinct. They intended for such decisions to be the result of extended deliberations, conducted by people who represent a broad cross-section of the country and its varied interests. On some days, it feels as though we have a government increasingly run by a combination of Truth Social posts and unsigned Supreme Court orders. That is probably not the preferable way for decisions of this magnitude to be made, as proven by the whiplash of the last 48 hours.

7. But back to Trumpworld cheerleading for a moment. Even more breathtaking than the Republican lawmakers standing by Trump has been the conservative media apparatus, which — except for Rupert Murdoch’s print properties — was similarly unflinching in its loyalty.

“You know what? I don’t really care about my 401(k) today,” Jeanine Pirro said on Fox News last week. “You know why? Not that I can afford it. Not that it isn’t important. Not that I’m not at a point in my life when I should be worried about my 401(k), because I am. But this is what I believe. I believe in this man.”

“Losing money costs you nothing,” conservative commentator Benny Johnson said on X amid the stock market crash. “This is just the reality of life. Are you young and dumb? How much money did you lose? Everyone loses money. It costs you nothing. In fact, it builds quite a bit of character. You learn a lot of lessons, actually, by losing money. Losing your character costs you everything. Losing your country costs you everything.”

“Don’t care,” Sean Davis, the CEO of the conservative website The Federalist, wrote in response to a news report that Air Jordans would were poised to become more expensive because of tariffs. “At all,” echoed Dan Bishop, who was sworn in as deputy director of the White House budget office last week.

Because of the nature of a two-party system, political parties in the United States have to cover a lot of ground, encompassing many disparate factions and interests. For that reason, as we’ve seen in Congress, it can help to have one uniting figure who papers over all those differences and gets all the factions to vote together more because of shared loyalty to a man than shared belief in a certain ideology.

But, in a democracy — where a party has to persuade voters, and not just its own, to retain power — it can also be very dangerous, because it leads to comments like those above: Don’t worry about losing money. Believe in this one man. MAGA media figures may think like that; it is unlikely American voters will. Republicans should be happy that Trump reversed himself, because that was not going to be a winning political message. If a party’s political/media class has convinced themselves that voters are willing to jump off a financial cliff out of loyalty to a politician, they are only destined to make decisions that will cost them at the ballot box.

According to YouGov data, charted here by the Financial Times, Trump’s approval has remained stable in the last few weeks among voters who identify as MAGA Republicans. But among the rest of the people who cast ballots for Trump in 2024 — which is most of them — his approval rating slipped during the tariff chaos.

The question for Trump is whether “Liberation Week” will be like the Afghanistan withdrawal for Biden (a moment when his approval rating began to fall, never to recover) or like the many scandals of his first term that Trump was able to come back from.

8. Where is Susie Wiles? As the chaos of Trump’s second term increasingly begins to mimic that of his first — yesterday, it was reported that the White House put the president on the phone with his aide-turned-antagonist H.R. McMaster when they meant to dial South Carolina Gov. Henry McMaster — it’s time to start considering the role of the “Ice Maiden” who was supposed to bring order to Trumpworld this time around.

In every dramatic episode of the last four months — DOGE, Signalgate, the tariff deliberations, etc. — Wiles has been in the room (or group chat), and yet it always seems to be others (Elon Musk, Michael Waltz, Howard Lutnick) who get blamed for the decisions. In the last week, we’ve also seen another familiar aspect of Trump 1.0 returning: the staff feuds.

White House senior adviser Elon Musk has spent the last few days calling fellow White House senior adviser Peter Navarro — the architect of Trump’s tariff strategy — a “moron,” “dumber than a sack of bricks,” and “Peter Retarrdo.” Karoline Leavitt laughed off the dispute, saying “boys will be boys.” But in previous administrations, this is exactly the sort of insubordination that a powerful White House chief of staff wouldn’t tolerate, and would nip in the bud immediately. If Wiles is unable to stop her subordinates from publicly calling each other morons — or to stop her boss from unveiling and then ditching major policies — it raises questions about how much power she wields behind the scenes.

9. Also, while we’re asking questions, what was up with this Truth Social post?

Trump sent this out about four hours before announcing the tariff pause, which caused a jump in the markets. Did he know he was going to do that at the time of the post? And who did he tell in between deciding and announcing, giving them time to buy?

Rep. Alexandria Ocasio-Cortez (D-NY) wrote yesterday that she was “hearing some interesting chatter on the floor” about members of Congress who bought stocks just before Trump’s announcement. That is a very vague allegation to make with no evidence to back it up. But it is a strange series of events, worthy of more investigation.

10. Finally, I want to take seriously the idea circulating in MAGA circles that Trump was planning this all along, and that the reversal is actually proof of a major victory. (Stephen Miller: “You have been watching the greatest economic master strategy from an American President in history.” The White House: “LET HIM COOK!”)

One X post I saw in this genre came from business Stefan Georgi, who wrote, “President Trump is so damn impressive and here’s why (don’t read if you have TDS),” referring to Trump Derangement Syndrome. Georgi continued:

First off, he continues to run the SAME playbook on repeat, and the whole world keeps falling for it. This playbook is:

1. Take an extreme position.

2. Take initial actions that show he’s committed to that extreme position.

3. Use people’s fear and belief as leverage to begin negotiations, get concessions, and secure what he feels to be a favorable deal.

He then summarized the back-and-forth of the last week, and added:

What Trump just did was create incredible leverage as he and his cabinet members go into negotiations with those 70 countries. And those countries realize they’re going to need to make major concessions because DJT isn’t messing around here (just look at China!). They also come with a feeling of gratitude because he just did them a favor by pausing the implementation of these tariffs. DJT and the U.S. have the upper hand entirely.

I am not convinced, precisely because — as Georgi wrote — Trump has tried to execute this playbook so many times, without many major agreements to show for it. Maybe announcing the tariffs and then reversing them will make other countries more likely to believe Trump is willing to impose steep punishments if they refuse to fall in line. But maybe it makes them less likely to believe that! I don’t know about you, but after watching the last week, are you more or less convinced that Trump is willing to accept the political and economic backlash that comes with imposing “reciprocal” tariffs?

You just have to listen to his own words. Trump allies may claim that this was part of a grand strategy, but by his account, Trump was cowed by the markets getting “yippy.” Doesn’t that mean other countries would have every reason to believe the same thing will happen next time? Each time Trump pulls this maneuver and then reverses himself, negotiating partners will become less and less likely to believe he’s willing to go the distance.

In general, the Trump administration is touting the president as a master dealmaker right now, but let’s wait to make any pronouncements until any new trade deals are actually struck, which hasn’t happened yet. If the president of the United States wanted to renegotiate our trade deals, he probably could have done it without threatening to throw the economy into a tailspin. So there’s really no sign the status quo has moved much in the U.S.’ favor, especially seeing as the credibility of Trump’s threats are now thrown into question.

What did we gain from this exercise? I don’t know, maybe a ratings boost for CNBC. What did we lose? Oh, only the certainty of the U.S. bond market’s status as a global safe haven. Not to mention that many companies are now more hesitant about investing in the U.S., since our trade policy appears to be conducted in instinct-driven, 90-day increments. (China, meanwhile, is trying to lure many of those manufacturers.) And American companies (and consumers) will now have to contend with the 10% universal tariff and a potential trade war with Beijing.

Throughout this whole affair, Trump and his advisers never fully articulated their goal for the tariffs: Was it restoring domestic manufacturing and moving towards full protectionism? Getting other countries to lower their trade barriers and moving towards free trade? Raising revenue to pay for tax cuts?

It’s hard to fully judge the effectiveness of a policy when you don’t even know what it was trying to accomplish. But no matter which of those goals you choose, there aren’t many signs the U.S. is any closer to achieving it than we were before the “Liberation Day” announcement. In fact, we may be farther.

11. See you back here in 89 days. Thank you for your attention to this matter!

You nailed it today Gabe. The fact that congress would capitulate to Trump even with the possibility of a depression tells me all I need to know about the current crop of republican congressmen and of course Fox News…Trump did not negotiate and I think it’s a huge mistake that the market moves 5 % on the headlines of one man. Read James Carville’s quote about the bond market and you will understand what happened.

Piro is just too proud or ideological to admit we are not heading in the right direction. It’s scary

Did Trump cross the line on telling people to buy stock right before he backed down from tariffs? Is this the same thing that caused Martha Stewart to go to federal prison?