Millions of Americans Mess Up Their Taxes. A New Law Will Help.

How bipartisan lawmakers (and “your voice at the IRS”) helped improve the tax system.

There’s a comedian named Joe Zimmerman who has a bit on — of all things — the U.S. tax system.

The video is below, but it goes like this:

My biggest fear about the government is just: taxes. I worry about it all year long, because other countries, the government will tell you what you owe, and then you just have to pay it. Here, the government’s like, “OK, what do you think you owe us?”

“I have no idea. Just tell me.”

“Nope, you gotta add it up. And then give it up.”

“Well, I’m really unorganized. What happens if I add it up wrong?”

“You could go to jail.”

Zimmerman is right that there are about 30 foreign countries that use “return-free” tax filing, in which the government assesses at least some citizens’ tax liabilities themselves based on information it already receives from employers. These countries send prepopulated tax returns to these citizens; the taxpayer can either say “Yep, looks good” and pay what the government says they owe or they can fill in missing information the government might not have had.

Versions of this system are used in the United Kingdom, Japan, South Korea, New Zealand, Germany, Italy, Spain, Denmark, Sweden, and the Netherlands, among other countries. California also briefly had a return-free system for state taxes, championed by Sam Bankman-Fried’s law professor father.

The idea of applying this nationwide in the U.S. has been endorsed by everyone from Ronald Reagan to Barack Obama, although the federal government really only has enough information to accurately prepopulate tax returns for around 45% of Americans. (Those other countries have much simpler tax codes than we do.)

Of course, Zimmerman is exaggerating for comedic effect, but where he’s wrong is that it’s highly unlikely you would go to jail for adding things up wrong on your taxes.

Not everyone is great at math, and there are so many numbers involved in tax returns that it’s very easy to make a mistake. You might be someone who is trying to pay all your taxes correctly, like Zimmerman, but end up making an honest error completely by accident. In these situations, the IRS has a system — in theory! — that’s supposed to make it easy to flag such math errors and get them quickly corrected.

In reality, however, this system has some holes in it, in a way that makes paying taxes more confusing for millions of Americans each year. Last week, President Trump signed a new law, the Internal Revenue Service Math and Taxpayer Help (IRS MATH) Act, designed to simplify at least this one part of our complicated tax code.

The legislation was bipartisan: sponsored by Sens. Bill Cassidy (R-LA) and Elizabeth Warren (D-MA) in the Senate and Reps. Randy Feenstra (R-IA) and Brad Schneider (D-IL) in the House, and approved unanimously by both chambers.

This morning, as part of my ongoing effort to let you in on the under-the-radar things Congress is actually getting done, let’s take a look at this new law and the problem it’s trying to fix. Paying taxes is a universal experience — and any of us could make an error at any time — which makes this law widely relevant to Americans, even if it’s received almost no coverage from major news outlets.

Ever since 1926, the IRS has had what’s called “math error authority”: the ability to quickly correct tax returns with simple arithmetic mistakes. As a House committee explained at the time:

In the case of a mere mathematical error appearing upon the face of the return, assessment of a tax due to such mathematical error may be made at any time, and that such assessment shall not be regarded as a deficiency notification.

In other words: No, you’re not going to jail for a simple math error!

In the modern era, the IRS feeds all of the tax returns it receives through a computer program, which automatically flags if someone added things up wrong. When that happens, the IRS then sends a “math error notice” to the taxpayer; the agency also sends such notices for other mistakes that are easily fixed, like if someone put the right information in the wrong place, if a return is internally inconsistent, or if someone gives the wrong Social Security Number or forgets to include one entirely.

About 2 million of these notices are usually sent out each year — although, as you can see below in this chart by the Tax Policy Center, that number skyrocketed to 17 million during the pandemic (primarily because of errors people made in claiming stimulus checks and the expanded Child Tax Credit).

If someone receives a math error notice in the mail, they have 60 days to quibble with it. If they don’t appeal within that timeframe, they are considered to owe the corrected amount the IRS is asking for. When everything works well, this is a win-win for the government and for the taxpayer: there’s no reason for either side to go through a more drawn-out and expensive audit or legal process if the only issue is that John wrote “$3,650” where he meant to put “3,506.”

In 2010, math error notices telling a taxpayer they underpaid led to the IRS receiving a total of $9.5 billion in tax revenue the agency was owed; math error notices about overpayments led to the IRS giving back a total of $6.2 billion.

Here’s the issue, though: The IRS notices are often really vague! Current law requires the agency to “set forth the error alleged and an explanation thereof,” but the IRS hasn’t really been doing that. Here’s an example of the type of notices people received for errors claiming stimulus checks during the pandemic:

We changed the amount claimed as Recovery Rebate Credit on your tax return. The error was in one or more of the following:

The Social Security number of one or more individuals claimed as a qualifying dependent was missing or incomplete.

The last name of one or more individuals claimed as a qualifying dependent does not match our records.

One or more individuals claimed as a qualifying dependent exceeds the age limit.

Your adjusted gross income exceeds $75,000 ($150,000 if married filing jointly, $112,500 if head of household).

The amount was computed incorrectly.

That’s not really helpful, is it? Millions of Americans get letters like this during Covid, which called attention to this issue, since many of them were very confused by the notices. If I made a mistake, why not just tell me what it is? Why give me a list of five potential mistakes I might have made and make me figure out which one? “The amount was computed incorrectly?” Can you maybe show me where and explain what about it was incorrect?

And, of course, people are only given 60 days to track down the error before they lose the chance to appeal. (They can still get the money back eventually if they think the “error” wasn’t an error, but after the 60-day mark, you still have to pay the money and then try to get it back as a refund, rather than having the chance to convince the IRS you don’t have to pay it at all.) Many Americans don’t understand the subtleties of the tax code. Or don’t have the time to rifle back through their tax returns to try to find an unspecified error. Or don’t know who to ask for help. Or have difficulty speaking English. This process could be so simple — “You made X error in Y place, fix it and we’ll be all set” — and yet it ends up adding a burden and confusing people every year.

To make matters worse, during Covid, some of the IRS letters didn’t tell people they could dispute the error or that they only had 60 days to do so (though the agency later fixed that practice); the notices also often neglect to tell taxpayers who they can call to help understand their mistake, or hide that information in a place where people won’t see it.

Did you know there’s someone at the IRS whose job it is to look out for you, the taxpayer, and lobby on your behalf? That person is the National Taxpayer Advocate, who leads an office of 1,500 employees who are supposed to be (as their slogan goes) “Your Voice at the IRS.” The position was created by the second Taxpayer Bill of Rights, passed by Congress in 1996; it is currently held by Erin Collins, who has had the job since 2020 and spent decades working in tax law before that.

Each year, the National Taxpayer Advocate puts out something called the “Purple Book,” a list of legislative recommendations she thinks Congress should enact to improve the life of the taxpayer. This year’s Purple Book was 198 pages long and included 69 recommendations.

For each of the last four years, Collins has proposed that Congress pass a law telling the IRS to fix their math error system, so that the notices sent out to Americans actually tell them what their mistake was and how long they have to appeal it. (It’s Recommendation #9 on this year’s list.) The IRS MATH Act, signed by Trump last week, is Congress finally taking her up on it.

Under the measure, the IRS math error notices will have to describe the “mathematical or clerical error” a taxpayer made “in comprehensive, plain language,” including by explaining to them “the nature of the error” and pointing them to “the specific line of the return on which the error was made.”

The IRS will also have to give an “itemized computation” of how the correction will change their adjusted gross income, taxable income, deduction amount, or tax credits.

Also, the notice will have to include the date by which the taxpayer has to appeal the correction before it becomes the updated amount they owe — “in bold, font size 14, and immediately next to the taxpayer’s address on page 1 of the notice,” the law specifically says — plus it has to give the IRS’ phone number so taxpayers know how to call if they want more information.

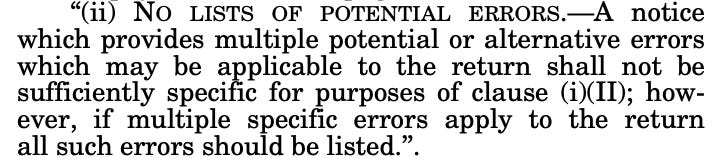

And in case all of that wasn’t clear enough, there’s also this:

This is Congress saying, We’re on to you, IRS. We know your games. NO LISTS OF POTENTIAL ERRORS. We’re saying up front that that’s not gonna satisfy our requirement.

All of this has to go into effect within 12 months. Finally, the law also includes a provision to create a pilot program to send a trial number of these notices by certified mail — which requires a recipient to sign and say they received a certain letter — as an attempt to ensure fewer Americans miss the letters in their mailboxes or think they might be spam.

The law requires the IRS to work with the National Taxpayer Advocate on the program, and then to report to Congress after 18 months on whether the pilot program improved taxpayer response rates to math error notices.

Speaking of the National Taxpayer Advocate, the House unanimously passed two more bipartisan bills this week to satisfy more of her Purple Book recommendations. The chamber approved the Fair and Accountable IRS Reviews Act, which would require an IRS employee to obtain written approval from their immediate supervisor before telling a taxpayer they owe a penalty (Recommendation #33), and the Tax Court Improvement Act, which makes changes to make the tax court process more efficient and fairer for taxpayers (Recommendations #45 and #47).

Earlier this year, the House also passed the National Taxpayer Advocate Enhancement Act, which will allow the National Taxpayer Advocate to hire tax attorneys for her office, to help improve her efforts to work on behalf of taxpayers (Recommendation #37). These measures have not yet been taken up by the Senate.

Most of the Purple Book recommendations — like the IRS MATH Act — are common-sense and bipartisan. “No one should have to spend a fortune on a lawyer or hours trying to figure out what went wrong on their taxes when the IRS already knows the answer,” Sen. Warren has said about the new law.

“An honest mistake on a tax return should be met with clear guidance from the IRS, not confusion,” Sen. Cassidy echoed.

Is this the biggest problem in the world? No. But all of us make math errors from time to time. And, each year, millions of Americans make mistakes on their tax returns that they’re willing to fix — but the IRS makes things unnecessarily confusing by not simply telling them how to. After a bipartisan effort by Cassidy, Warren, and others, life will be made at least a little bit easier for these taxpayers.

One recommendation down, 68 to go.

Fascinating. Thanks for highlighting a part of the IRS that the current administration has, surprisingly, left alone. I'm stunned it hasn't apparently lost employees due to DOGE or other choices made in the last year. I spent three years as a part-time tax preparer after I retired from the Army and moved to Missouri. My wife and I were both Army officers who'd never been stationed in our home states so did not have to complete a state tax return. I took the prep course to learn how to do that and got hired. I even taught the basic tax prep classes the company required for a year.

I've received those IRS letters when I've made an error, and I've also had to interpret them for tax clients, and they're hard to understand. I'm happy to see that there's now an effort to make that process simpler. I should mention that every IRS employee I met in my tax prep days was unfailingly smart, courteous, and genuinely helpful. The folks you mention here certainly exemplify that.

Here's the problem. That same company that I worked for has joined others in the world of tax preparation in keeping our tax system complicated so it can keep its business model intact. That group also got the IRS to shut down its free tax prep system (though not its free e-filing system) that basically does what other countries you mention do. And other countries have simpler tax codes than we do, so having the government send an estimate of taxes owed is also much simpler. The scandal is deliberately keeping our tax system complicated for the benefit of the few, connected entities who can influence legislation with campaign contributions.

I wish this mentioned the IRS's Direct File program, which allowed people to file their tax returns directly to the government for free like those 30 countries. The tax prep industry spend decades lobbying against any improvements like that, and then Direct File was shut down by the Trump administration. https://www.propublica.org/article/inside-turbotax-20-year-fight-to-stop-americans-from-filing-their-taxes-for-free