A Reader’s Guide to the Big Beautiful Bill, Part 1

It’s not as hard as you think!

Every time I write about a piece of legislation in this newsletter, I always make sure to include a link to the bill text, so you can read it for yourself if you want.

I’m not sure how many of you actually take me up on that.

Which is fair! The One Big Beautiful Bill Act, for example, which President Trump signed into law last week, is more than 150,000 words long. If you want to read roughly 150,000 words, you’ll probably settle down with The Scarlet Letter or The Grapes of Wrath (or approximately 100 issues of Wake Up To Politics), not a piece of budget legislation.

But the One Big Beautiful Bill Act — which, against my will, I will refer to as “OBBBA” for the rest of this newsletter — is important. It will likely cut your taxes. It might change federal benefits you receive. It will grow parts of your government and shrink others.

In a way, it’s also a crucial annual report written by employees of yours, in the sense that you were involved in hiring its authors last year and will be given the opportunity to say whether you want to renew or end their contracts next November. This is their way of telling you the biggest things they’ve accomplished since their hiring.

So before you make a decision about their employment, you should know what’s in it.

Of course, there’s no shortage of pieces out there summarizing the package. (I should know: I’ve written a few of them). But, as far as I can tell, there’s no available guide that really tries to walk people through reading the whole thing — piece by piece — instead of just focusing on all the flashiest parts or all the oddities.

And that’s why I set out to write one, with three goals:

To help you understand (hopefully in an accessible and somewhat engaging way) the specifics of everything the OBBBA does, beyond just the vague sense you might get (from Republicans) that “we cuts your taxes!” or (from Democrats) that “they cut your Medicaid!”

To help you learn more about your government. As you’ll see below, the U.S. government has its hands in so many areas of American life. We all know about Medicaid and Social Security. But how about the Sheep Production and Marketing Grant Program? The bill, in its own way, offers a fascinating tour through some of the lesser-known arms of the American government, and reading it is a cool way to learn about all the things you never knew your tax dollars were going to.

To help you learn how to read an act of Congress, so maybe the next time a bill is linked in WUTP, it won’t seem so intimidating.

Reading legislation really isn’t as hard as you think! You’ll see: we’ll do it together.

That said, the bill is long. So I’ll be doing this in multiple parts. For ease of organization, we’ll split it into titles (there are 10 in all, one for each committee that helped draft it) and try to get through a few titles each day, with a few days in between each installment.

Before we dive in: This is a new experiment! Let me know in the comments whether you found this helpful and how it could be improved. That will help me know how to make Part 2 better and whether you want to see “reader’s guides” like this for other bills.

Putting this together took a fair amount of research. I’m only able to spend my time immersing myself in projects like this because of support from paid subscribers. I thought about paywalling this series, but ultimately felt this was important information for everyone to have access to. If you want to help support this sort of work, click below to become a paid subscriber:

OK, let’s get reading. Here’s a download link if you want to follow along. We’ll start on Page 1 of 330.

Front Matter

The package starts out simple enough, with its title:

Note that the formal title is not the One Big Beautiful Act. As loyal readers will recall, Republicans used the reconciliation process to pass the package along party lines and, according to something called the Byrd Rule, everything in a reconciliation bill has to be related to the budget.

Even the title! That’s how Democrats succeeded in striking the GOP’s preferred title from the official text. (H.Con.Res. 14 is the budget resolution that acted as a blueprint for the package.) I will still call it the OBBBA in this newsletter, instead of “An act to provide for reconciliation pursuant to title II of H.Con.Res.14.” (Or “AATPFRPTT2OHCR14” for short!) Don’t tell the parliamentarian.

Next we have the table of contents, which is eight pages long, and tells us how the bill will be organized: by titles, and then (for some titles) by subtitle, and then by section. I’ll touch on every title and subtitle in these reader’s guides (there are 10 and 28, respectively), but not necessarily every section. I’ll sometimes quote the text directly (and give you a sense of how to read it in conjunction with other important texts), but usually will write in my own words — though always in order of how things are in the bill, to help those reading along at home.

Title I: Agriculture, Nutrition, and Forestry (pp. 9-40)

The Supplemental Nutrition Assistance Program (SNAP), formerly known as food stamps, is a program that helps low-income Americans buy groceries. The program was also originally designed as a way for the government to help support farmers, by increasing demand for their products, which is part of why it’s administered by the Agriculture Department and falls under this title.

Food stamp benefits are allotted according to the Thrifty Food Plan (TFP), which is the government’s estimate of how much money a “healthy, budget-conscious” family needs for groceries. The plan was traditionally increased by the Agriculture Department according to inflation, but in 2021, the Biden administration used that power to unilaterally implement a 21% increase, the largest in history. (Vox called it the administration’s “biggest achievement” that “almost no one has heard about.”)

The OBBBA keeps the Biden-era change in place (at least for now), but prevents any future administration from adjusting the TFP amounts except to keep pace with inflation.

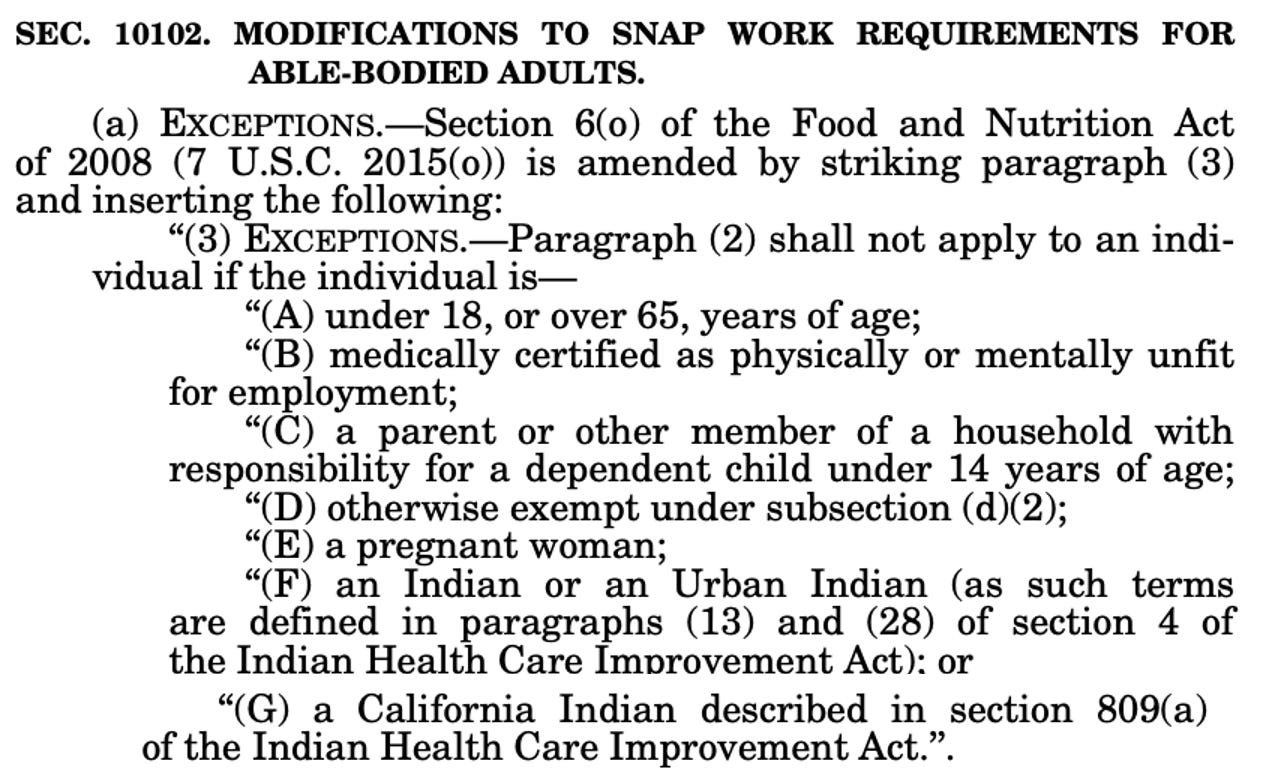

SNAP benefits already come with 20-hour-a-week work requirements, but the OBBA would shrink the pool of people exempt from those requirements. This is a good moment to dip into the text of the bill itself, which we’ll do occasionally, in order to show on a granular level how acts of Congress go about changing public policy. This is from Page 10:

Most bills don’t write law. They amend them. So, in this case, to understand what the provision is actually changing, we have to go to Title 7, Section 2015, Subsection (o), Paragraph 3 of the U.S. Code, where the existing SNAP statute lays out who is exempt from work requirements (which are laid out in Paragraph 2):

If we do that, we see that the work requirements currently lapse at age 55, so the OBBA moving the maximum to 65 puts anyone 55-64 newly under their reach. We also see that veterans, homeless people, parents of dependents older than 14, and former foster care youth older than 18 but younger than 24 have been removed from the list of exempted groups, while Native Americans have been added.

That’s the kind of side-by-side comparison you have to constantly be doing, to look at the old law and understand what’s different about the new law. Usually I’ll let you do that on your own if you want, but at a few points, we’ll do it together.

The bill goes on to empower the Agriculture Secretary to waive the work requirements for a state that is “noncontiguous…and has an unemployment rate that is at or above 1.5 times the national unemployment rate.” (This is one of several parts of the bill that were added to appeal to Sen. Lisa Murkowski, a key swing vote, although currently neither her home state of Alaska nor Hawaii has low enough unemployment to meet this standard.)

SNAP benefits are awarded based on income. The old law allows recipients to not count energy assistance they receive from a state government towards their income. The OBBA will only allow that for households “with an elderly or disabled member.” Recipients can also deduct their utility expenses from their income, but the OBBA will clarify that that deduction does not include the cost of internet service.

Currently, the federal government pays 100% of the cost of food stamps. (They split the administrative costs with states, which distribute the benefits.) The OBBA will change that, under a “Quality Control” scheme that correlates with a state’s payment error rate (how often states are under- or over-paying recipients). States with error rates under 6% won’t be on the hook for any benefit costs, states with error rates between 6-8% will have to pay for 5% of the costs, states with error rates between 8-10% will have to pay 10%, and states with error above above 10% will have to pay 15% of costs.

But here’s the catch. Under a section titled “Delayed implementation,” the OBBA also says that states with especially high error rates won’t have to start the cost sharing until Fiscal Years 2029 or 2030, instead of FY 2028 like everyone else (meaning, for at least a year or two, states with lower error rates will be paying more than states with higher error rates, incentivizing states to keep the error rates high for the time being). This goes back to Murkowski too: Alaska is the state with the highest SNAP error rate (originally, this carve-out was going to apply only to her state, but the parliamentarian made Republicans broaden it).

Starting in FY 2027, all states will also be on the hook for 75% of administrative costs, instead of the current 50%.

The OBBA also ends a nutrition education and obesity prevention grant program that has been part of SNAP since 1992. Finally, the package prevents SNAP benefits from going to almost anyone who isn’t a citizen or green cold holder. Already, immigrants here illegally are disqualified from benefits, but the OBBA would exclude most refugees, who currently do receive SNAP benefits. However, the package does specifically allow Cuban and Haitian refugees to keep their benefits.

Here’s all we’ve got in this subtitle:

“Public Law 117–169” is the Inflation Reduction Act, the Democratic reconciliation package from 2022, so this subtitle is clawing back certain funds from that bill that haven’t yet been spent. (Live by reconciliation, die by reconciliation.)

If you go to the sections of the IRA in question, you see’ll see that the rescinded funds mostly have to do with forest conservation and climate mitigation.

Usually, every five or six years, Congress passes a big bipartisan package known as a “farm bill” that reauthorizes all sorts of agriculture programs and subsidies for farmers. The last one passed in 2018 and expired in 2023; in a symbol of congressional dysfunction, instead of writing a new one, lawmakers have now extended the old one twice, with the latest extension going until the end of FY 2025.

Perhaps fearing that the two parties wouldn’t be able to agree on a new one before then, Republicans included a bunch of provisions in the next few subtitles that would normally go in a farm bill.

That includes adjustments to the reference prices that the government uses to subsidize farmers who produce key commodities like corn and wheat (when the market price drops below the reference price, the government pays the farmers a certain amount). Farmers qualify for these payments based on their number of “base acres” (acres historically used to farm the key commodities); the OBBBA would allow 30 million new base acres to be claimed.

The bill also updates and extends other farm assistance programs that were set to expire and sets new rates for farm loans. If you want to know the new for grain sorghum or the new loan for the large chickpea, this subtitle is for you.

This subtitle expands the Livestock Indemnity Program, the Livestock Forage Disaster Program, the Tree Assistance Program, and Emergency Assistance for Livestock, Honeybees, and Farm-Raised Fish, doing things like setting a normal mortality rate for honeybee colony losses (15%) and creating an aid category for farmers facing losses due to attacks on their farms by “piscivorous birds.”

Piscivorous birds are birds that eat fish. You learn something new every day.

The government also gives crop insurance benefits to beginning farmers and ranchers in their first five years of starting out. The OBBA increases the benefits, and offer them to farmers and ranchers in their first 10 years.

Among other changes, this subtitle also creates a Poultry Insurance Pilot Program, to insure poultry growers from “extreme weather-related risk resulting in increased utility cost.”

Here we’ve got funding for all sorts of agriculture programs, including the Environmental Quality Incentives Program, the Grassroots Source Water Protection Program, and the Feral Swine Eradication and Control Pilot Program. (Feral swines, beware!)

The Emergency Food Assistance Program, which purchases food to go to local food banks and soup kitchens, was also extended through 2031. A bunch of other programs were also extended, from the Emergency Citrus Disease Research and Development Trust Fund to the Sheep Production and Marketing Grant Program.

A program to boost agriculture trade was created, and more scholarships were authored for 1890 Institutions, which are historically Black colleges and universities that offer agriculture education.

Congrats, we made it through our first title! 40 pages down!

Title II: Armed Services (pp. 41-54)

This title isn’t split into subtitles, but it’s much shorter and everything is pretty straightforward. There are no cuts, just a bunch of new money appropriated to the Defense Department. ($157 billion in all.)

One notable thing here is $25 billion set aside for Trump’s proposed Golden Dome missile defense system. It’s not called that in the text, though. Here’s how it describes itself, on page 44:

On Page 54, you also see $1 billion appropriated for the Defense Department to play a role in border operations:

I won’t walk through everything funded by this title, but these are the pages to look at if you’re curious about how the Pentagon is spending its new funds. Here are a few other line items from the title that caught my eye…

Several categories of AI funding, including:

More child care assistance for troops:

Money for 5G and 6G systems for the military:

Remember the Chinese spy balloon? Yes, we do the same thing:

And funding to purchase B-21 bombers, which are the next-generation aircraft set to replace the B-2 stealth bombers that were used to drop the “bunker buster” bombs used against Iran last month:

I could go all day — isn’t this fun?!? — but, out of respect for your time, we’ll call it there for our first installment.

We’ll pick up with Title III (Banking, Housing, and Urban Affairs!) soon. In the meantime, let me know what you think of this new experiment in the comments. And, as always, send any questions or things you’re curious about.

Thanks for embarking on this reading journey with me! See you next time.

This is exceptionally helpful. It is a straight-forward no nonsense deep dive that none of us really want to have to make. The linkage to amended laws is really well done, allowing one to see in side by side comparison what has happened. Well done!!

this is FANTASTIC! easy to read & digestible. looking forward to the next part 👍