Good morning! It’s Monday, June 5, 2023. The 2024 elections are 519 days away. If this newsletter was forwarded to you, subscribe here. If you want to contribute to support my work, donate here.

This will be a busy week in the 2024 presidential race, as three new candidates — Mike Pence, Chris Christie, and Doug Burgum (the governor of North Dakota, of course) — prepare to enter the Republican primary field.

I’ll have more coverage of their announcements and how they’ll affect the 2024 race (or, more likely, how they won’t affect it) later in the week. For now, I want to take a moment to go into Q&A mode and answer a few reader questions I’ve received over the past few days.

At its best, I like to think of this newsletter as a daily civics lesson in your inbox, with the central goal that you finish each email having learned something about the American political system you otherwise wouldn’t have. I always find Q&A columns like this one an especially great way to achieve that goal. I love the interesting questions you all send in; hopefully, even if you didn’t ask the question yourself, you find the answers helpful. Let’s go to it:

Suspended animation

Dave P. asks: If the debt ceiling is “suspended,” and therefore the U.S. can issue as much new debt as it needs/wants until the suspension ends, what happens then? Absent a new bill to raise the ceiling above what’s already been issued (or to raise the ceiling, but not as much as has already been borrowed by that time), would it revert to its current level? And what would that mean, if the U.S. suddenly owed more than the official ceiling authorized?

When the U.S. has neared its debt ceiling in the modern era, Congress has generally done one of two things: either raised the ceiling to a new amount, or suspended the ceiling until a later date.

The suspension option is one that came about fairly recently, in 2013, and it has been popular in recent years because it allows lawmakers to avoid putting a dollar amount on the federal debt. (“Congressman X voted to raise the debt ceiling to $30 trillion” can be a potent attack line in some primaries.)

The Fiscal Responsibility Act, which President Biden signed into law on Saturday, takes advantage of that option, suspending the debt ceiling until January 1, 2025. At that date, does the ceiling revert back to its last set amount, $31.4 trillion?

No, the ceiling is just automatically raised by however much debt was borrowed by the U.S. Treasury during that time. Between now and January 2025, the U.S. can continue borrowing at will as if the debt limit does not exist; then, on 1/1/25, however much debt is held by the Treasury becomes the new limit, whether it be $32 trillion or $33 trillion or anything else. (Congress would then have to suspend or raise the ceiling again to avoid default, although you may recall from this year’s standoff that Treasury has a suite of “extraordinary measures” that can help temporarily, meaning the deadline would come later in 2025, not suddenly on January 2.)

Note: This is not a free pass for the Treasury to borrow whatever it wants. In advance of the deadline, Janet Yellen couldn’t just call for an inordinate amount of money to be suddenly borrowed, to ensure that the U.S. can fund its spending obligations long after January 1.

In fact, the Fiscal Responsibility Act specifically forbids this: “The Secretary of the Treasury shall not issue obligations during the period specified in subsection (a) for the purpose of increasing the cash balance above normal operating balances in anticipation of the expiration of such period.”

Between now and January 2025, the law states, money can only be borrowed if “the issuance of such [debt is] necessary to fund a commitment incurred pursuant to law by the Federal Government that required payment before January 2, 2025.”

House vs. Senate

Lindsey S. asks: I was wondering if you could provide any insight as to why the majority of “yea” votes for the Fiscal Responsibility Act in the House came from Republicans, while the majority in the Senate came from Democrats. It seems odd to me that the support would shift from chamber to chamber.”

Actually, the majority of “yea” votes in both chambers came from Democrats (52% of “yea” votes in the House, 70% of “yea” votes in the Senate), a reflection of how good Democrats feel about the deal Biden struck.

But Lindsey still has a point: clearly, in the Senate, the bill was carried a lot more by Democratic support than in the House. In total, 68% of House Republicans supported the package, compared to only 35% of Senate Republicans. Why such a drop-off?

I have two theories:

There was a less concerted whipping effort in the Senate. Kevin McCarthy’s speakership was arguably on the line in the House vote. He had promised that 2/3 of his members would support the package — which meant he needed to get that amount, to maintain strength and to show his right-wing rivals that they were in a small minority (and would also be in a minority in a “motion to vacate” vote). Although he supported this deal, Mitch McConnell, on the other hand, was less identified with it; that meant he had less to lose. His position as Minority Leader was not threatened by whether or not the deal received a high number of GOP votes — and the deal wasn’t threatened either, because it was more assured in the Senate that Democrats, as the majority party, could (and would) carry it across the finish line. As a result, McConnell didn’t whip his members like McCarthy did, knowing a smaller handful of them needed to fall in line for the deal to pass.

This was a House product, not a Senate product. Most of the bipartisan deals in recent memory have come from the Senate, either from deals involving Chuck Schumer and Mitch McConnell or involving “gangs” of rank-and-file Senate members. It is rare for House members to play the crucial dealmaker role — and yet, in this deal, Kevin McCarthy took the lead, while Senate Republicans were fairly marginalized. Paul Kane has a great piece in the Washington Post about this dynamic, but for our purposes, I’ll just say that Senate Republicans felt less buy-in to the deal because they hadn’t been part of crafting it. In particular, defense hawks in the Senate GOP were angry that military spending didn’t see a bigger increase. (There are also inter-chamber jealousies at play here. As the old House joke goes: “The other party isn’t the enemy. They’re the opposition. The Senate is the enemy.”)

Time machine

Rick M. asks: Can you refresh our memories on why the House and the Senate did not take up Janet Yellen’s admonition to raise the debt ceiling during the lame duck session when the Democrats still had a hold on both chambers? In retrospect, this must have been one of Nancy Pelosi’s biggest blunders.

In retrospect, many Democrats regret not raising (or even eliminating) the debt ceiling when they had full control of Congress, including during the lame duck session after the 2022 midterms.

But it’s probably unfair to blame Nancy Pelosi. The truth is, Democrats simply would not have had the votes to raise the debt limit unilaterally. Remember: doing so would have required Democrats to use the reconciliation process, which allows the majority party in the Senate to advance bills with only a simple majority, as opposed to the 60-vote majority normally needed due to the filibuster. But because Democrats only had 50 senators at the time, every Democratic senator would have had to support the bill for it to pass.

In all likelihood, Pelosi would have been able to whip her Democrats in the House into supporting a debt limit reconciliation bill — but there’s really no way Joe Manchin would have gone for it (he said as much at the time). That would have given the bill only 49 votes in the Senate, depriving it of a majority and dooming it to failure.

More news you should know

The grand jury in the Trump documents case is set to meet this week after several weeks without convening, NBC News reports. The return could be a sign that Special Counsel Jack Smith is preparing to seek an unprecedented federal indictment of the former president, although it is not clear if that’s the case.

Related: “Trump Lawyer’s Notes Could Be a Key in the Classified Documents Inquiry” (NYT)... “Justice Department will not seek criminal charges in Pence classified document probe” (CNN)

Senate Republicans have received some good news about 2024 races in recent weeks, Politico notes. The GOP scored a key recruit in West Virginia (Gov. Jim Justice), while two candidates who could have caused headaches for the party decided to forgo campaigns (Doug Mastriano in Pennsylvania and Warren Davidson in Ohio). These developments provide a boost to the Republicans’ hopes of retaking the Senate, which are already strong due to a heavily favorable map.

Ukraine has cultivated a network of agents inside Russia who have carried out acts of sabotage against Russian targets, CNN reports. “U.S. officials believe these pro-Ukrainian agents inside Russia carried out a drone attack that targeted the Kremlin in early May by launching drones from within Russia rather than flying them from Ukraine into Moscow,” according to the network.

Donald Trump continues to praise Kim Jong Un, the murderous North Korean dictator. Trump posted a congratulatory note to Kim on Friday after North Korea was elected to the World Health Organization executive board. Trump’s Republican rivals, including Nikki Haley, Ron DeSantis, and Mike Pence, quickly criticized him for the post. During his presidency, Trump repeatedly praised Kim and referred to “love letters” written between them.

Today’s political planner

All times Eastern.

President Biden will meet with Prime Minister Mette Frederiksen of Denmark and welcome the Kansas City Chiefs to the White House to celebrate their Super Bowl victory.

Vice President Harris has nothing on her public schedule.

The Senate is out until tomorrow.

The House will vote on up to seven bills related to investing.

The Supreme Court will release orders in pending cases.

Before I go...

I want to say a few words about my grandmother, Linda Randall, who sadly passed away this weekend.

It is hard to imagine anyone more compassionate or loving than my Nana. A practicing therapist for nearly fifty years, she had an amazing ability to connect with people and care about people — both her clients and her family, for whom there was little she wouldn’t do. She always knew just what to ask to get someone to open up to her, and then what to say to soothe their problems.

She was a woman of incredible willpower, who amazed us again and again with her strength these past few months. She simply refused to quit: in fact, she was still seeing clients up until a few weeks ago, even as she was living with both Parkinson’s disease and cancer.

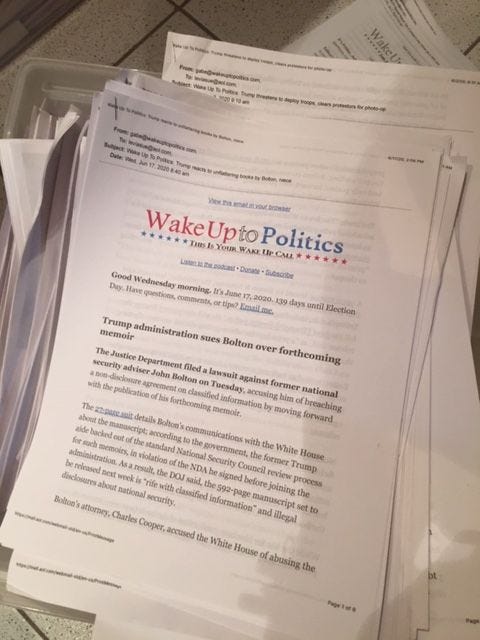

She loved each of her children and grandchildren, and showed it to us in countless ways. As one example: for years, from the time this newsletter began to shortly before she passed, she printed every single copy of Wake Up To Politics and lovingly stored them each night in a box she kept in her office. Soon, one box became several: the Wake Up To Politics archives, she called it. That was how much she believed in all of us and tried to support and be a part of all of our pursuits.

We love you, Nana, and we miss you.

Thanks for reading.

I get up each morning to write Wake Up To Politics because I’m committed to offering an independent and reliable news source that helps you navigate our political system and understand what’s going on in government.

The newsletter is completely free and ad-free — but if you appreciate the work that goes into it, here’s how you can help:

Donate to support my work or set up a recurring donation (akin to a regular subscription to another news outlet).

Buy some WUTP merchandise to show off your support (and score a cool mug or hoodie in the process!)

Tell your family, friends, and colleagues to sign up at wakeuptopolitics.com. Every forward helps!

If you have any questions or feedback, feel free to email me: my inbox is always open.

Thanks so much for waking up to politics! Have a great day.

— Gabe