Understanding Biden’s student loans plan

by Gabe Fleisher

Good morning! It’s Thursday, August 25, 2022. Election Day 2022 is 75 days away. Election Day 2024 is 803 days away.

In this morning’s newsletter: A dive into the details of President Biden’s student loan debt cancellation — who it impacts, how he’s doing it, and what it might mean politically.

Understanding Biden’s student loans plan

After months of weighing his options, President Biden announced a plan on Wednesday to forgive federal student loan debt for millions of borrowers. Here are answers to the questions you might be asking:

Who qualifies for the new relief? Under Biden’s plan, any Americans whose annual income is less than $125,000 (or $250,000 for married couples filing jointly) will qualify to have up to $10,000 of their federal student loan debt canceled.

Americans who received Pell Grants — a federal subsidy that helps low-income students attend college — will be able to relieve up to $20,000 of their federal student loan debt, as long as they are under the $125,000 income threshold.

Eligibility will be based on borrowers’ income on either their 2020 or 2021 tax returns; the program will only be available to those who took out loans through June of this year. If borrowers are dependent students, then their eligibility will be based on their parents’ income. Parents who took out loans for their children through the federal Parent PLUS program will also qualify, as will borrowers who obtained loans to pay for their graduate education.

How many people will that affect? According to a White House estimate, if all borrowers claim the relief they qualify for, Biden’s move will provide relief for up to 43 million borrowers — including canceling all remaining federal student loan debt for about 20 million.

That will make it the largest student loan debt cancellation in U.S. history.

Americans will have to apply to qualify for the debt relief, using an online application that has yet to be made available.

What other changes to the student loan program did Biden announce? Biden also announced that the Education Department would begin the rulemaking process to change how federal student loan repayment works for undergraduate borrowers.

Currently, the amount borrowers have to repay each month is capped at 10% of their discretionary income (their annual income, not including taxes and the expenses they have to pay to live, like food, medicine, and rent). They must then continue their monthly payments for 20 years, after which their remaining debt is canceled, as long as their original loan balance was $12,000 or less.

The Education Department will move to change the cap for monthly payments to 5% of discretionary income, and make it so remaining debt is canceled after 10 years of payments. Biden also proposed raising the amount of income that is considered non-discretionary (and therefore protected from repayment), guaranteeing that those living on the federal minimum wage will only have $0 monthly payments.

These changes will cut monthly payments in half for undergraduate borrowers, and only require them to pay off their loans for half as long.

And what about the Covid-era moratorium on repaying federal student loans? Biden extended it one last time, through December 31, 2022. That means that no borrowers with federal student loan debt will have to repay their loans for the rest of 2022 (as has been the case since March 2020), but monthly repayments will resume in January 2023.

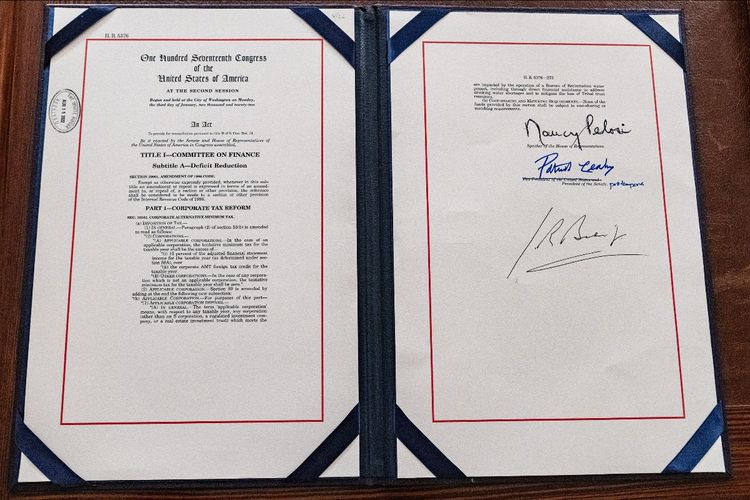

Under what authority is Biden canceling student loan debt? When a senior administration official was asked this question in a call to brief reporters on Wednesday, they struggled to answer.

But the Education Department released a memorandum that said Biden was using the Higher Education Relief Opportunities for Students Act of 2003, also known as the HEROES Act, as the legal justification for the debt cancellation.

The 2003 law gives the Education Secretary the power to “waive or modify any statutory or regulatory provision” related to federal student loans as the Secretary “deems necessary in connection with a war or other military operation or national emergency.” The Biden administration is considering the Covid-19 pandemic as the “national emergency” that applies here.

This interpretation of the law is likely to be tested in the courts in the coming months.

What are the arguments for and against student loan relief? Critics of Biden’s plan have called it unfair (since it will provide no relief to those who already repaid their student loans or who never took any out or didn’t attend college) and warned that it could exacerbate inflation (since it will free up more money to chase the same amount of goods).

Opponents have also pointed to a Penn Wharton analysis estimating that Biden’s plan would cost taxpayers around $300 billion. The analysis also found that about 40% of the debt cancellation would be for people in the top 40% of income levels.

“President Biden’s inflation is crushing working families, and his answer is to give away even more government money to elites with higher salaries,” Senate Minority Leader Mitch McConnell said in a statement.

Biden, meanwhile, argued that the entire economy would be “better off” when “people can start finally to climb out from under that mountain of debt,” which would allow them to inject more money into the economy.

He also pointed to the rising costs of college to explain why the move was necessary. When asked if the plan was unfair to people who paid their student loans or didn’t take any out, Biden responded: “Is it fair to people who in fact do not own multi-billion dollar businesses to see one of these guys getting all the tax credits? Is that fair?”

Will this have an impact on the midterms? It’s hard to say. The move could ensure higher turnout among progressive Democrats, especially young voters (who largely disapprove of Biden), although the president’s action was not as expansive as some on the left hoped.

On the other hand, it might ignite anger among people without college educations who were left out of the relief — especially if it leads to worsening inflation.

The idea tends to poll fairly well: an NPR/Ipsos poll in June found that 55% of Americans support forgiving up to $10,000 in federal student loan debt.

What else you should know

ABORTION: “A federal judge on Wednesday blocked Idaho from enforcing a ban on abortions when pregnant women require emergency care, a day after a judge in Texas ruled against President Joe Biden's administration on the same issue.” Reuters

IMMIGRATION: “The Biden administration on Wednesday took another step to try to preserve the Obama-era Deferred Action for Childhood Arrivals program, which allows hundreds of thousands of undocumented immigrants brought to the US as children to stay and work in the country.” CNN

CLIMATE: “California is poised to set a 2035 deadline for all new cars, trucks, and SUVs sold in the state to be powered by electricity or hydrogen, an ambitious step that will reshape the U.S. car market by speeding the transition to more climate-friendly vehicles.” Associated Press

Today’s political daybook

All times Eastern. Click on an event’s time to watch it.

President Joe Biden will travel to Montgomery County, Maryland to participate in a Democratic National Committee fundraiser (5 pm) and then a rally (7 pm). Afterward, he will return to the White House (8:25 pm).

Vice President Kamala Harris is on vacation in Kauai, Hawaii. She has nothing on her public schedule.

White House press secretary Karine Jean-Pierre will hold her daily press briefing (12:45 pm).

The Senate is on recess until September 6.

The House is on recess until September 13.

The Supreme Court is on recess until October 3.

That’s it for today. If you enjoy Wake Up To Politics, it’s always appreciated if you donate to support the newsletter or buy some merch. Or if you tell your friends and family to sign up at wakeuptopolitics.com.

If you have any questions or feedback, feel free to email me: my inbox is always open.

Thanks for waking up to politics! Have a great day.

— Gabe